Your Ultimate Source for Tailored Auto Funding Providers: Changing Your Lorry Dreams Into Fact

Browsing the complex landscape of vehicle financing can usually really feel like a daunting task, specifically when aiming to turn your desire for owning an automobile into a substantial reality. With the appropriate resource at your disposal, customized car financing solutions can simplify this procedure and make it a lot more accessible. Visualize having a partner that not just recognizes your special funding requirements but likewise provides tailored services to match your specific scenarios. This degree of expertise and guidance can make all the distinction in protecting the suitable financing for your dream cars and truck.

Understanding Your Funding Demands

Next, review the type of lorry you want purchasing and just how it lines up with your lifestyle and future strategies. Assess whether a brand-new or secondhand automobile would better fit your requirements and monetary abilities. Furthermore, consider the car loan term that would certainly function best for you-- whether a shorter term with greater month-to-month payments or a longer term with lower month-to-month payments is a lot more viable.

Personalized Financing Solutions

Personalized financing services may consist of alternatives such as safe loans, unsafe financings, leasing, or dealership funding (Top Chevy dealership). Each of these alternatives has its very own collection of advantages and factors to consider, making it important to evaluate them against your details demands. Protected lendings, for instance, may offer reduced interest prices however call for security, while leasing supplies flexibility yet may feature mileage constraints

Functioning closely with an economic advisor or auto funding specialist can assist you navigate the complexities of personalized funding services and make informed decisions that lead the way for turning your lorry dreams right into reality.

Step-by-Step Application Refine

Navigating the application process for customized automobile funding services involves an organized series continue reading this of steps targeted at promoting a seamless and reliable experience for prospective debtors. To start the process, applicants are typically needed to fill in a thorough application supplying essential personal, monetary, and vehicle information. This info assists the funding supplier examine the debtor's credit reliability and customize an appropriate financing bundle.

When the application is submitted, the next action usually entails a comprehensive evaluation by the financing company. This review might consist of validating the supplied info, inspecting credit report, and analyzing the candidate's economic security. Following this analysis, the funding provider will communicate the decision to the candidate, laying out the regards to the proposed financing arrangement.

Expert Advice on Funding Alternatives

Amidst the myriad car loan choices offered, obtaining experienced support can considerably enhance your understanding of customized cars and truck financing solutions. Navigating the intricacies of finance choices requires a keen eye for information and a complete understanding of the monetary ramifications. Specialist support can help you understand the intricate details of each financing choice, such as rate of interest, repayment terms, and prospective surprise charges. By looking for advice from experts in the area of automobile funding, you can make informed decisions that straighten with your financial objectives and lorry preferences.

Whether you are looking for a lower interest price, a longer payment period, or an extra my response flexible loan framework, professionals can aid you identify the most ideal financing remedy. Inevitably, professional advice on funding options can encourage you to make confident and educated choices when funding your desire car.

Safeguarding Your Dream Auto Financing

Embarking on the trip to safeguard your dream car financing demands a critical and careful approach tailored go to my site to your special economic situations. To start, it is vital to examine your existing financial standing. Examine your credit report, earnings security, existing debts, and cost savings to figure out just how much you can afford to borrow and conveniently pay off. Research study numerous lenders, including banks, credit scores unions, and on the internet banks, to contrast rates of interest, financing terms, and eligibility requirements.

When you have actually determined prospective lenders, gather all necessary paperwork, such as proof of earnings, identification, and residency, to streamline the application procedure. Be prepared to negotiate terms to protect the most positive bargain feasible. Take into consideration getting the assistance of a monetary consultant or cars and truck financing expert to direct you with the complexities of the car loan application and approval process.

Remember to review the great print of any lending agreement carefully prior to authorizing to prevent any hidden charges or unfavorable terms. By taking an aggressive and educated approach to safeguarding your dream vehicle funding, you can turn your lorry ambitions right into a truth while maintaining monetary stability.

Final Thought

Finally, customized cars and truck financing solutions offer individualized options to fulfill individual requirements, guiding clients via the application process and providing skilled advice on finance options. By securing the right funding, individuals can turn their car dreams right into fact. With the help of these services, consumers can make enlightened decisions and accomplish their objective of having their desire automobile.

Joseph Mazzello Then & Now!

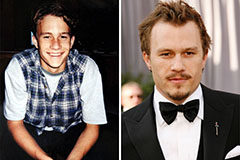

Joseph Mazzello Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!